Last Updated on August 8, 2022 by lindseymahoney

On today’s episode of From the Nest Podcast, Chris and I talk about buying an investment property site unseen! We are breaking down how we found this deal and our deal analysis that made interested in this rental property.

How did we find this income property?

An out of town investor found me through Instagram

Stats on the House:

- Square Feet: 1,100

- Bedrooms: 3

- Bathrooms:1

- B-C neighborhood

Methods of Researching a Property without going Inside:

- Research the home and neighborhood on Zillow

- Take a virtual tour using google earth (if you can’t drive by the house)

- Drive past the house and through the neighborhood

- Walk the neighborhood and talk to the neighbors* (This is where you will get a lot of really great insight)

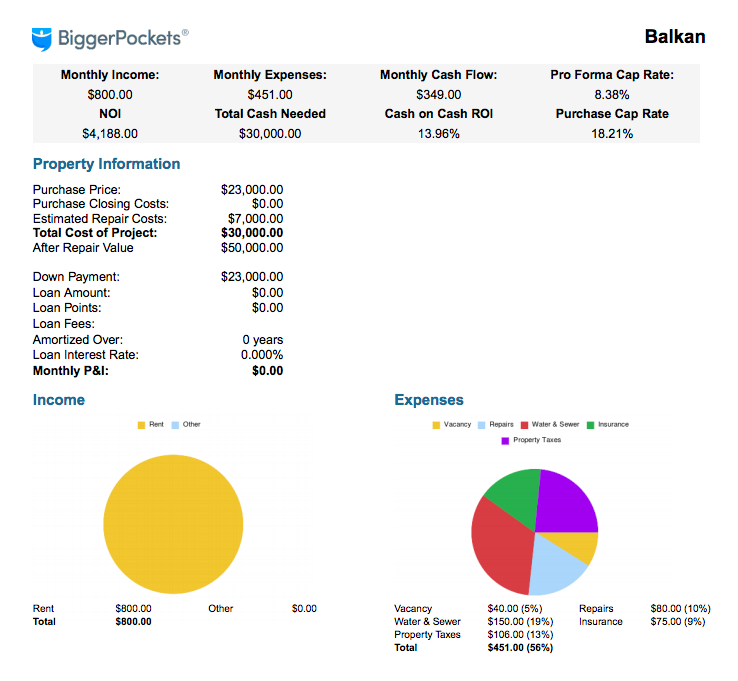

Crunching the numbers:

- Asking price: $23K

- Renovation Estimate: $7K

- Total Cost of Project: $30K

- Estimated monthly rent: $750-$800

- ARV (after renovation value): $50K (based on comps)

Back of the Napkin Math:

2% Rule:

- The 2% rule says that for a rental property investment to be “good”, the monthly rent should be equal to or higher than 2% of the purchase price.

- $30,000 * 2% = $600/month

- $800/$30,000 = 2.67%

Cap Rate:

- The capitalization rate, often just called the cap rate, is the ratio of Net Operating Income (NOI) to property asset value.

- Purchase Price = $23,000

- Gross Annual Income: $800 * 12 = $9,600

- Monthly Operating Expenses: $451 * 12 = $5,412

- Insurance: $75

- Water & Sewer: $150

- Property Taxes: $106

- Vacancy: $40 (5%)

- Repairs: $80 (10%)

- (9,600-5,412)/23,000 = 18.2%

50% Rule:

- The rule states that — on average — the total expenses associated with operating a SFH investment will be about 50% of the gross rents.

- $451/$800=56%

Bigger Pockets has a great website that allows you to analyze deals and connect with other investors.

Show Notes:

THIS WEEK…

- Here is the house that we would LOVE to buy for our family but are probably not at this point yet

- Here is a picture of the house we toured with bullet holes through the front

TIPS OF THE WEEK…

Chris: Tip one – don’t cut trim hungover! Tip 2! When cutting outside corners at 45 degree angles, give an extra 1/8 inch to the measurement because you can always cut the excess and it is better than cutting it too short.

- For inside corner angles, check out this tutorial by Bob Villa – it is super helpful and makes a really tight corner.

Lindsey: Cost saving Tip – if you want to save money on your tile installation, ask the tiler if you can be his apprentice to cut down on the cost. I was able to pay 1/3 of the original quoted labor cost by offering my services as the helper. So the tiler came in for one day and helped me set up all of the tiles and made all of the appropriate cuts with his tools and I completed the grouting the next day. No only did I save money, but I was able to learn a new skill!

Take a tour of our first Toledo rental property here! If you enjoyed this episode, don’t forget to subscribe, rate and review us on iTunes! Thanks for listening!